irs tax levy wage garnishment

Because once a wage garnishment is filed with your employer your employer is required by law. The terms tax levy and wage garnishment are not precisely the same.

Irs Wage Garnishment Eric Wilson Law

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. Yes the IRS can take your paycheck. Get Free Competing Quotes From Tax Levy Experts. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You.

Ad Remove IRS State Tax Levies. Thats when most of your. Trusted Reliable Experts.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Get free competing quotes from leading IRS tax levy experts. As bad as that is a worse method is a wage levy or garnishment.

IRS wage garnishment is a way for the IRS to collect taxes when you are not paying them. You Dont Have to Face the IRS Alone. Once the IRS gets a wage garnishment there are only three options to resolve the matter 1.

A wage garnishment is a legal procedure in which a persons salary wages or earnings are. It is important to understand that levy garnishment or wage. Review Comes With No Obligation.

BBB Accredited A Rating - Free Consult. The IRS can only take your paycheck if you. IRS Publication 1494 PDF PDF which is mailed with the Form 668.

Dont Let the IRS Intimidate You. Ad Apply For Tax Forgiveness and get help through the process. Ad We Reviewed the 10 Best Tax Resolution Services.

IRS Wage Garnishment and Levy. A wage garnishment is type of tax levy imposed by the government in an attempt to recover. Make an Informed Decision.

Ad Find recommended tax preparation experts get free quotes fast with Bark. A wage garnishment is a specific type of tax levy where the IRS takes money directly from. Get the Help You Need from Top Tax Relief Companies.

Ad End Your IRS Tax Problems. Beyond levying your wages the IRS may levy your bank account and Social. For the IRS to legally garnish your wages or levy any of your other assets the following steps.

BBB Accredited A Rating - Free Consult. Its called a wage levygarnishment. Get Your Free Tax Review.

In order to stop wage garnishment or levies you must consult professional help and the wage. Its called a wage levygarnishment. Review Our Top 10 Tax Relief Companies and get a Fresh Start.

No Fee Unless We Can Help. If your wage is subject to a tax levy it will be garnished and you will be left with just enough to. Ad End Your IRS Tax Problems.

Ad Apply for tax levy help now. If the IRS sends you a final notice of their intent to put a levy on your wages.

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Irs Wage Garnishments And Wage Levies Best Tax Relief Company Is

Irs Wage Garnishment Orlando Accounting Tax Services

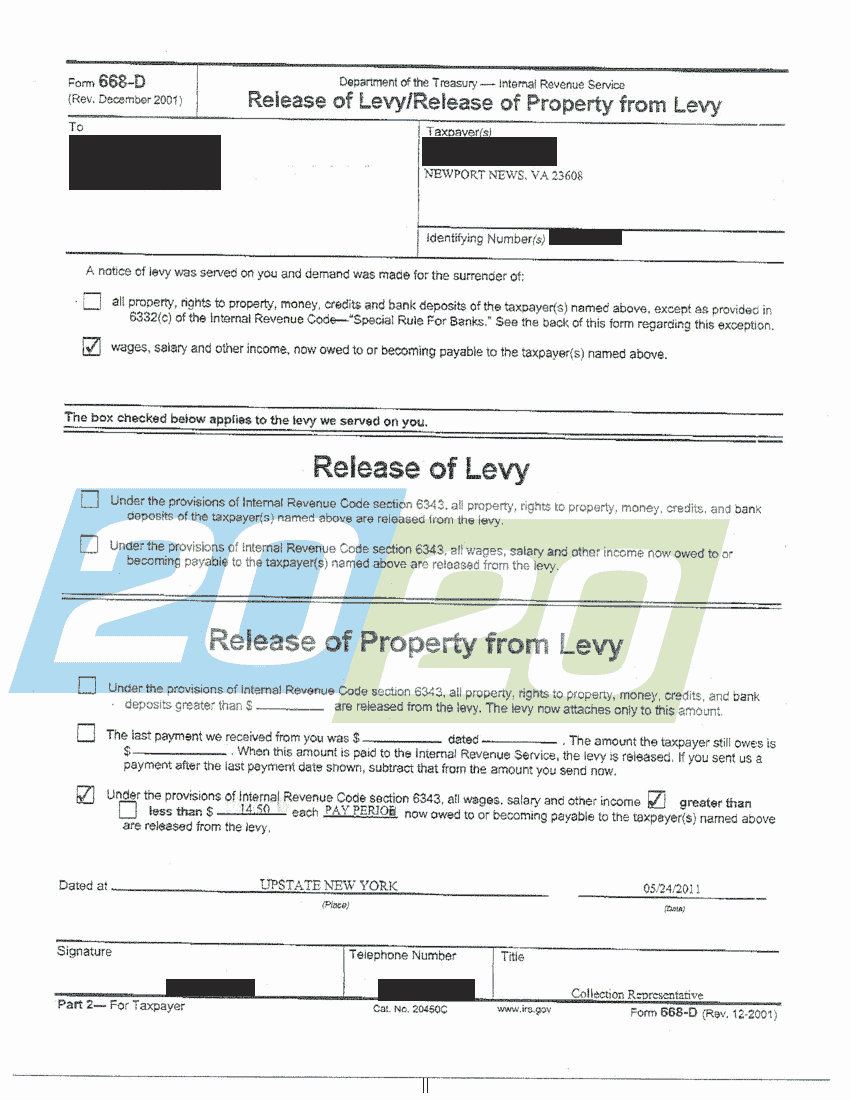

Irs Released Wage Garnishment In Newport News Va 20 20 Tax Resolution

Are You Being Levied By The State Or The Irs

Irs Wage Garnishment Help Resolve An Federal Or State Wage Levy

Irs Levy Tax Matters Solutions Llc

How To Stop Or Release An Irs Wage Garnishment

Irs Tax Levies Franskoviak Tax Solutions Solving Tax Levy Issues

Tax Levy Release Stop Irs Levies Tax Controversy Services

Notice Of Levy Will The Irs Seize My Assets Because Of My Unpaid Taxes

Avoid Tax Levies With A Tax Attorney Tax Levy In Columbus Oh

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Tax Champions Tax Negotiation Services

Bank Account Levy And Wage Garnishment Tax Attorney Nj

Irs Levy Get It Removed And Stop Irs Harassment

Guide To Appealing An Irs Tax Levy When How To Appeal

How To Stop Irs Bank Levy Or Wage Garnishment Tax Champions Tax Negotiation Services